The next “mini Public

Bank” company.

I Have. Have you?

Most investors must have wished that they had bought

some Public Bank shares in the early days when it was listed in 1967. Or

perhaps at some point of times. One

thousand shares of Public Bank at that time would have turned into over several

thousands shares as at today and when you multiply the current share price of

RM17, the value would be over more than RM1 million today for that investor,

not to mention the thousand and thousand of dividends received. (Provided the

original investor possessed the “heart of steel” to hold on over a period of 46

years!)

In my personal opinion, not many people would be able

to do that. Imagine during the 46 years’ period, there were so many world

crisis now and then that would have emotionally influenced that investor to

sell the shares at some point of times. The 2008-2009 world global credit

crunch would have given that investor with the so-called “heart of steel” many

sleepless nights wondering if it was better to dispose off the shares for

whatever profits left or to just hang on and hope for the best or face the

reality of seeing his paper profit’s

value decreasing. Over during this long period, the investor must not be in an

urgent situation for need of urgent cash, too.

There is this one very good friend of mine who bought

2,000 shares of Public Bank about 15 years ago at less than RM2.00. But because

he was just a novice, he was constantly affected by the movement of the

composite index that he had to check with his remisier every half an hour about

his share prices. Eventually the emotion got over him and he sold off his

shares at almost the same price after several months. In fact, I had to ask for

his permission to write this. He laughingly agreed provided his name is not

mentioned.

Then again, that investor if he is around today must

be over in his late 60s or 70s or even 80s years old. Shares that provided an

investor with such “monsters’ returns” are hard to come by. Perhaps once in a

lifetime opportunity. To put it in a simple way, finding the next Public Bank

is like finding a needle in a haystack if you know what I meant by that.

But if one has been observant enough, there were

actually many mini “Public Bank” companies too in Bursa Malaysia. Some examples

are Nestles, Dutch Lady, Hartalega, Top Gloves, Genting and Digi and many

mores. (For Digi, surely Tan Sri Vincent Tan of Berjaya Group would vouch for

it). If only one had invested just one thousand shares in most of these

companies at IPO prices or even post-IPO prices. He would surely need a doctor

to stop him from laughing non stop every day and all the way to the bank

whenever he sees his shares’ price rising and receiving tons of cash dividends

now and then.

The writer has been fortunate enough to own a “mini Public Bank” company. No right, no

wrong, this is the writer’s own version of his “mini Public Bank” company.

Keck Seng (M) Berhad

More than a decade ago, when I was always hungry

searching for investments reports of companies, I chanced upon an article on

Keck Seng (M) Berhad in the Sunday Mail column. Those days, Sunday Mail would

featured an article upon a certain company each week. At that time, the article

introduced Keck Seng as an asset rich company with plenty of lands in Johore

and is engaged in the cultivation of oil palm, processing and marketing of

refined palm oil products, property development, property investment and share

investment holding. The Company operates in four segments: manufacturing,

hotels and resorts, property and plantation.

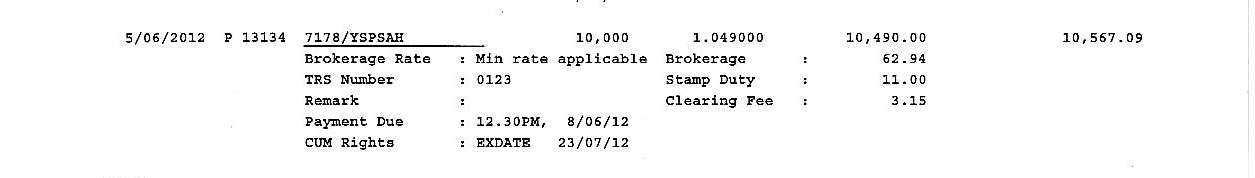

So I went on

to purchase my first 1,000 shares of Keck Seng at RM1.65 on Nov 2nd 1999. It

was on behalf of my spouse and she had some spare money to invest. And I went

on to purchase an additional 5,000 shares (for my ownself) when the price kept

going down all the way over the next few years. (Prices bought were at RM1.34

on June 5th 2002, RM1.38 and RM1.39 on June 14th 2002, RM1.22 on Oct 9th 2002

and RM1.20 on Feb 21st 2003). In fact the share prices went below RM1 for quite

some times and stayed there for long period after my total purchase of 6,000

shares). Surely I must have regret for believing in that Sunday Mail’s article!

Surely Keck Seng wasn’t a nice words to mention about when discussing about

investment with my spouse.

But over the next several years, Keck Seng’s

investment into securities appreciated more and more apart from their regular

business. Each year when I read its annual report, I noticed that its

investments values were increasing and increasing! Slowly and surely, the share

prices was also increasing every year.

Land’s prices in Johore was also becoming more and

more expensive. Yet most of Keck Seng’s land were valued at its original

prices, way below the current market’s value. Keck Seng was attracting the

attention of several research houses and

it was quite common to see an article of Keck Seng in The Star, The Edge

or even the Chinese newspapers being featured now and then. (The writer still

keeps stacks of Keck Seng’s articles in his library).

Keck Seng could declare a bumper dividend of RM359m

or 96 sen/share by virtue of its section 108 balance which will be expiring by

December 2013. Keck Seng will be better off making full use of the credit

balance as any unutilized credit balance will be forfeited.

Perhaps one of Keck Seng’s major move was investing

in Parkway shares that netted them nearly RM260 million when Parkway shares

were eventually taken private a few years ago. Keck Seng, majority owned by Ho

Kian Guan and family from Singapore, is also a very conservative company and

its average dividends payout is about 10 sen per year.

On July 6th 2010, I sold off my 5,000 shares of Keck

Seng at RM4.96 when I needed some money for a major purchase item. That was

before Keck Seng implemented a one for two bonus shares exercise. The reason I

did not sell all was because that 1,000

shares belonged to my spouse! (Luckily for her and unluckily for me) because

post after the one for two bonus shares exercise, the 1,000 shares has now

increased to 1,500 shares multiplied by the current shares prices of RM5.35

that is worth about around RM8,000.

Minus out the last 13 years of dividends received and

you can see that the RM8000 is almost free. Twenty years from now, how much

will the share price of Keck Seng be? There could be more bonus exercises,

bumper dividends or perhaps a privatization exercise. By then, the writer will

be in his early 70s, hopefully if he is still there by then.

Have you got any “mini Public Bank” company’s story

to share with? The writer and many other readers would be very happy to hear

from you.

Hup Seng Industries Berhad

Incidentally by the time I was writing this article,

another “Seng” has just released its second quarter results. Hup Seng

Industries Berhad announced an earning of 8.92 sen bringing its first half

yearly earnings to 16.34 sen. Investors including this writer would be happy

that the company is rewarding shareholders with a 15 sen dividend to be paid at

a later date.

The writer can be contacted by his email at kassim123888@gmail.com