Customer-turned-Stakeholder

of YSP Sah.

Backache is common among us and is

no exception for my spouse.

For several years, she experienced

irritating back pain on the back now and then. A good friend introduced her to

try on a capsule supplement formulated herbs traditionally used for relieving

waist ache and backache, it is called Elgucare. The main pharmacological

effects are dilating the blood vessels to improve blood circulation, restring

the fibro-elastic potential of vertebral cartilages and improving immune

system. She tried and after a period of time, her pain was gone. And so from

time to time, whenever she felt some pain, I would go to the pharmacy to

purchase Elgucare capsule again.

However early last year as I was

doing some house cleaning, I chanced upon some Elgucare bottles and out of

curiosity, read the label and discovered that it was distributed under the

famous brand "Shine" by a company called YSP Southeast Asia Holding

(YSP Sah).

That led me to start doing a

research on the company. And what I found out interested me more and more. It

was a simple profitable small company. It was a cash-rich company. It was

consistently paying regular dividends year after years. And it was consistently

making profits year after year including even at the peak of the US credit

crunch crisis in 2008/09.

Most important, YSP Sah was only

traded at only RM1.04 at a low PER at that time. At such a low price, the

dividend of RM60.00 is almost a near 6%, much higher than the bank's fixed

interest rate. How could I missed out such a good company for so long having

been its regular customer (buying the Elgucare for my wife) for so many years?

Incidentally, YSP Sah shot into

the attention of the investing public when it was mentioned in the hugely

followed blog of SERIOUS INVESTING on May 22, 2013. The title was: "YSP:

You Shall Pass?" SERIOUS INVESTING's Felicity gave some detailed account

of the company and bought 7,500shares of YSP Sah at RM1.17.

Then on July 15, 2013, YSP Sah was

again in the spotlight, this time The Edge publishing a more than half page

article entitled: "YSP overlooked by investors". In that article, YSP

Sah's president and group managing director Datuk Dr Lee Fang Hsin said the

company was fortunate enough to go into the Indonesian market early when it

opened up its pharmaceutical industry and allowed full foreign ownership. Soon

after that, the Indonesian government closed the window of opportunity for the

late comers. Indonesian is a much bigger market than Malaysia. Even Pharmaniaga

is also entering the Indonesian market albeit a bit late. (But better be late

than missing out this huge market opportunity).

YSH Sah is expanding its foothold

in Asean. It has branches in Singapore, Vietnam, Myanmar, Cambodia and

Indonesia and is now looking to expand by setting up new manufacturing plants

in Indonesia and expanding its capacity in Vietnam. However, Malaysia still remains

the key contributor. Although YSP Sah in still in a growth stage that requires

capital investment, its dividend policy of 50% remains.

Going by its strong 1st Quarter

2013's results of eps of 3.34sen, a dividend of 6.5sen or 7sen is expected for

investors next year.

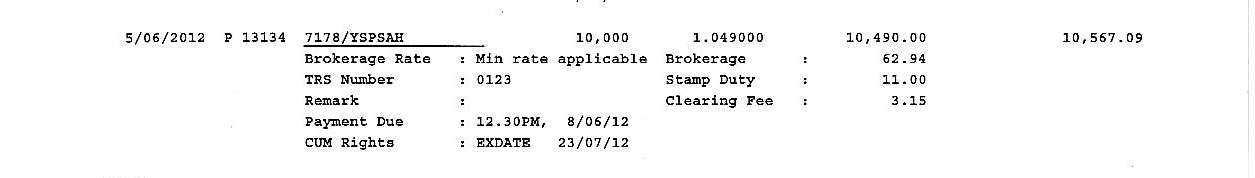

The writer bought 10,000 shares of

YSP Sah on June 5, 2012 at RM1.05. To date, he had received two dividends totaling

RM1, 250.00 (RM600.00 on August 22, 2012 and RM650.00 on August 5, 2013).

Currently the share price has appreciated to around RM1.40 at the time of

writing.

Readers are welcome to share

investing ideas and experience with me.

My email is kassim123888@gmail.com

Hi, dear Kassim thank you for your precious sharing. How do you perceive the current downturn trend? Any KLSE entry point for consideration? Thank you. (At my own risk).Cheers.

ReplyDelete