Chicken and Duck Talk

One of the best Chinese humorous movies ever is the

famous and successful award-winning film called : Chicken and Duck Talk. A 1988 film co-written by Michael Hui who also

starred together with his two brothers Sam Hui and the late Ricky Hui, the film

is about the conflict that ensues between the proprietor of a BBQ duck

restaurant that is in trouble for health violations and the fast food chicken

restaurant that opens across the street.

Chicken and Duck Talk movie was the highest-grossing

Hong Kong film released in 1988. Even until today, when the tv station reruns

the shows, I bet that the show would continue to bring out the laughter from

the living rooms for hours.

Why is the movie called Chicken and Duck Talk? It is a

Chinese idiom for people

not understanding each other.

Recently Kassim had a very embarrassing moment when

a Chicken and Duck Talk situation

happened. Kassim was putting 10 oranges (each 39 sen) into a white plastic

sheet (during that moment, my mind must be somewhere else, maybe thinking of

which stock to study) at a hypermarket. When I approached the hypermarket's

assistant, I showed him my ten fingers (to tell him that there were 10

oranges). However he sticked a price tag of RM4.29 on my package, I thought he

had mistaken my oranges as of different type, hence the different price instead

of RM3.90. The assistant is a Bangladesh and his accent (must be Bangla-Melayu

combination) was obviously not understood by me.

I explained to him in simple Bahasa Malaysia language

that there were 10 oranges and the price should be RM3.90. I even used my

finger to draw the figure 10 x 39 sen while he was trying to explain something

that I could not understand.

In the end, he teared up the plastic and counted the

oranges for me. There were 11 oranges! How embarrassing for me at that moment

as there was a long queue of people behind me looking at me! They must have

thought that Kassim was trying to "cheat" 1 orange!

It was obviously right from the start that he was

trying to tell me that I had packed in 11 oranges (unfortunately I could not

understand) instead of 10 oranges.

Such embarrassing situation would not have happened if

in the first place, I had carefully counted the oranges number to be correct!

Also, if only the assistant had been someone who could speak simple clear

language or dialect that I would understand that I had packed in 11 oranges

instead of 10.

See, this is the consequence of a Chicken and Duck Talk

situation.

I had decided to open my blog this time with some entertaining happenings instead of shooting

straight at stock market. The point is .... life is not about stock market

every day and nite. Ha ha ..

Well, I am sure embarrassing situations happen to

almost everyone sometimes here and there to us. Do you have one to share with?

If you have one and would like to share, please email to me.

The Sixth Sense

"Sixth sense, or subtle perception ability, is

our ability to perceive the subtle-dimension or the unseen world of angels,

ghosts, Heaven (Swarga), etc. It also includes our ability to understand the

subtle cause and effect relationship behind many events, which is beyond the

understanding of the intellect. Extrasensory perception (ESP), clairvoyance,

premonition, intuition are synonymous with sixth sense or subtle perception

ability." This

is what I gathered after a google search.

Do you know of anyone with a sixth sense? I doubt if

that anyone would want to let us know that he/she has that sixth sense. That

person would rather use it to his/her own benefits. In fact, it would be very

dangerous to let others know of your sixth sense ability. You could be

kidnapped by some bad guys and forced to use your sixth sense for their

benefits.

But I do know that sixth sense seems to prevail in

Bursa Malaysia, sometimes with sharp accuracy. Take for example, the current

rather hot stock Tek

Seng Holdings Berhad. Normally a very

quiet stock with thin trading volume, Tek Seng has seen its trading volume

increasing by leaps and bound since the early weeks of August.

In my previous blog, I pondered why the sudden massive

interest for Tek Seng shares. I believed my pondering question was answered

when on Aug 22, Tek Seng announced a profit of earnings per share of 4.1 sen!

Incidentally, Tek Seng closed at 50.5 sen

on heavy volume of 10,200,400 shares on that day.

The good result propelled Tek Seng to close even

higher at 62.5 sen in the next trading day on Aug 25 with a even higher volume

of 32,470,600 shares.

Since then, Tek Seng has settled to close at 58.5 sen

on Aug 29.

Those investors who bought Tek Seng shares before the

results were released on Aug 22 must have known something about it. Otherwise,

how could one explain the massive trading volume. Perhaps, some of them

possessed the "sixth sense".

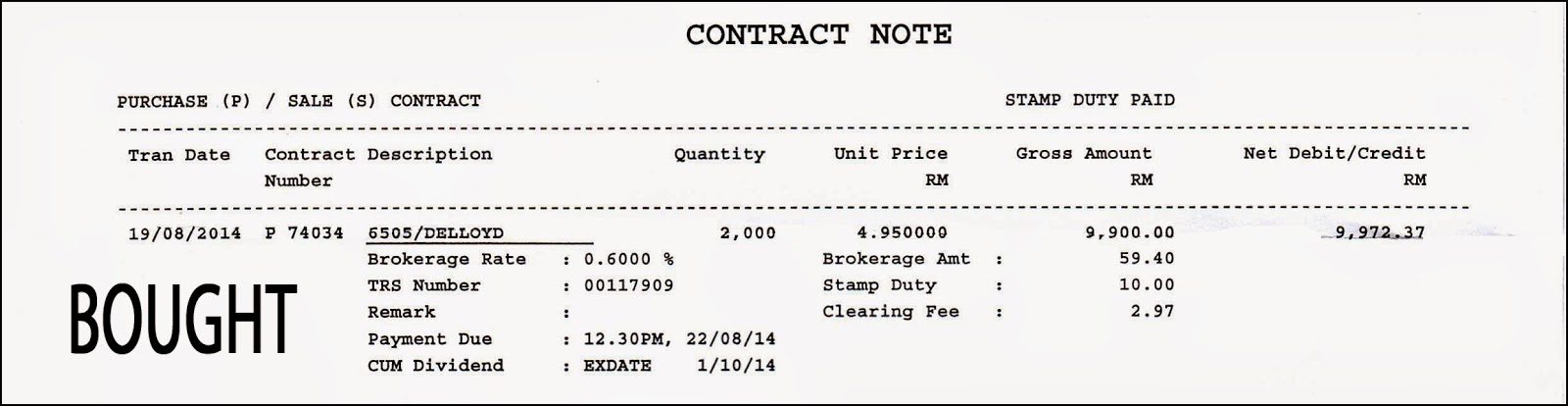

Buying shares of Delloyd Ventures Berhad

A recent article in Kinibiz in the Tiger

Talk page commented about the revised

offer for Delloyd

Ventures Berhad for minority

shareholders. The offerer, obviously fearing that the earlier offered RM4.80

per share was not going to entice the minority shareholders enough, quickly

upped the offer price by 40 sen per share to RM5.20 per share.

It is very clear that the major controlling

shareholders must have realised that

Delloyd owns some assets that are potentially worth far, far beyond the

current book values. If benchmarked against recent transacted prices of its

land according to the National Property Information Centre (Bapic), a unit of

the Ministry of Finance, its two assets would be worth nearly RM2.1 billion!

According to Tiger's very simple analysis, that is

RM764.8 million to be distributed across about 35.18 million shares. In other

words, about RM21

per share!

Even the Minority

Shareholders Watchdog Group (MSWG) are of the view that the revalued assets of

Delloyd could fetch higher value than its current book value.

Recent privatisation exercises were all not smooth

sailing for its offerers. Take the recent classic case of MISC which were not

successful. The minorities were vindicated in the end! The share price of MISC

has since then surged to higher price than the offered price!

Kassim is of the opinion

that those with spare money (to be able to park for several years and including

forgoing the potential interest rates if kept inside the bank) would have a

greater chance of reward if they dare to buy some Delloyd shares and keep it.

Sharing your opinion must

also be backed with your own action. Otherwise, people may also ask you back

that since you say it is good, why are you not buying it?

Hence, Kassim bought 2,000 shares of Delloyd on Aug

19, 2014 at RM4.95. Together with the broking and stamp duty plus clearing fee,

the amount totalled RM9,972.37.

At the time of posting this blog on Aug 29, Delloyd

share price closed at RM4.95, mostly trading between RM4.91 and RM4.96 since my

purchase. This proved that Kassim did not have the "sixth sense"

ability like most of us although the majority of my investments have been

rather very profitable!

Kassim urges all minorities

shareholders of Delloyd to stand firm and not to give in. When we are united,

the major shareholders/offerers will be forced to eventually offer us an even

higher price.

Who is with me?

By the way, Selamat Merdeka Day to all

Malaysians!

No comments:

Post a Comment